Small Businesses Need Credit

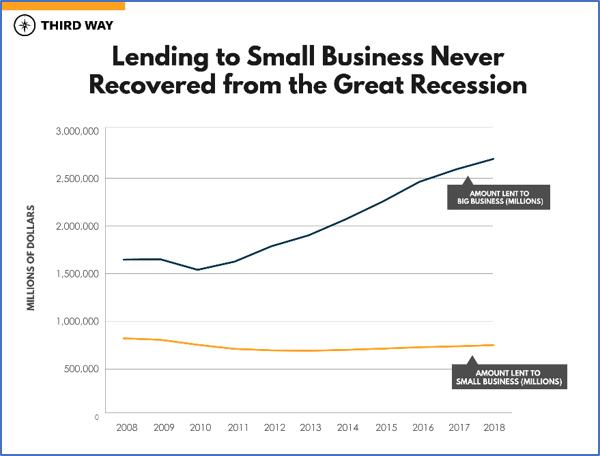

According to a study by the Federal Reserve, 64% of small businesses experienced financial challenges. These challenges were particularly acute for startups and those with smaller annual revenues. Half of small business applicants secured less than the full amount of credit requested, affecting their ability to meet expenses or grow.

“The challenge for many small businesses is that cash is the lifeblood of a company,” said G. Gerry Hays, professor of venture capital at the Indiana University Kelley School of Business. “You have to have the money needed to pay rent, employees and to pay yourself, or you’re not going to be in business very long.”

However, merchant cash income will typically lag cash outflow because the company starts

paying rent, acquiring inventory, and incurring other start-up business expenses before making the first sale. Payroll is another expense that, at least in the early going, may need to be paid before enough revenue from sales covers the expense. And, as Hays mentioned, the business owner will want to be able to pay himself or herself as well.

Importance of Small Business Credit

Beyond the reasons mentioned above, credit is important to small businesses for several reasons.

- Better Purchasing Opportunities: Small businesses with access to credit can take advantage of opportunities when they become available. For example, a supplier might offer a temporary steep discount on products or services that you regularly use in a business. Of particular note is that merchants and other small businesses are more likely to do more business with whoever provides them with credit, helping to establish a long-term business relationship between creditor and borrower.A line of credit gives the ability to take advantage of such discounts when they occur, cutting the business expenses and enhancing cash flow.

- Better Opportunity for Growth: By reinvesting in the business, small companies can grow to a sustainable size. This is particularly important in the early years for the company to become established. According to ScaleFactor, 34 percent of the smallest SMBs (1-19 employees) and 43 percent of SMBs with 20-99 employees use credit cards as their top funding source, reinvesting profits to grow the company.

- Maintains separation between personal and business credit: Owners of very small businesses can be tempted to use personal credit cards and other personal forms of financing to keep their businesses running. While that might be unavoidable as a business starts, it’s important to separate personal and business finances. Doing so could put you at risk if your business is ever in trouble.

- Personal finances are not a good long-term source of funding, Hays points out. While some people use personal credit, including lines of credit on their homes, personal credit cards and other types of debt to fund a business, particularly in the beginning, it’s important that the business start building its own credit history and credit score.

- Establishes Credit History for Future Use: A business needs establish its own credit history and credit score not only to help protect a business owner’s personal

assets but also to obtain better rates and have higher credit availability in the future. A business can start building a credit history by buying and paying off small amounts of credit at the beginning. Even if the business has cash on hand, the small borrowing amounts will incur little if any interest expense (depending on the credit vehicle used),and will establish the creditworthiness for when larger amounts are truly needed. The better the credit history, the better the interest rate the business will be able to obtain. - Easy Access to Emergency Funding: In addition to giving the business the ability to take advantage of available discounts, the availability of credit on known terms helps businesses when they have unexpected expenses, such as a prime piece of equipment failing, late payment from a supplier or a myriad of other reasons. With ready credit, the business doesn’t need to scramble to pay to get the equipment fixed or handle other short-term emergencies.

Consider Form of Credit

Whereas with a small business loan a company needs to pay on the entire amount initially borrowed (minus any principal payments), with a business credit card, the business pays interest on only the unpaid balance on the due date. For example, a $10,000 business loan will provide the business with $10,000 at the start and a periodic payment schedule. Prepayments may or may not be allowed, based on the loan agreement. With a $10,000 available on a business credit card, however, the business can borrow just what it needs, when it needs it. The business may need only $9,000 for 20 days past the due date. As long as the business makes the minimum payment, it would pay interest on the outstanding amount. If paid on day 20, then another $5,000 is accessed later, it would borrow that and pay interest on that amount until repaid.

The PayVus Solution

PayVus® is a bundled business solution combining card acceptance and a business credit card into one single product— which helps you better manage cash flow and make accepting cards more cost-effective. By enrolling in the program, you will receive all the benefits of being issued a MasterCard World Business Credit Card.

The PayVus business credit card offers qualified merchants up to a $10,000 line of credit to increase capacity to pay for supplies, buy inventory, and manage everyday business expenses.

Additionally, you can designate a portion of your daily settlement to be split between the PayVus credit card and regular bank account. Funds deposited to the credit card are posted as a credit balance and are available for immediate use. Your merchant acquirer can sign you up, and it is quick and easy, and within 5 business days of signup, PayVus can help you achieve your business goals faster.